Multifamily Market Overview

Bothell

The submarket is home to two employment hubs—North Creek and Canyon Park. The former contains several tech and telecommunications firms such as Google and T-Mobile. The latter is the where biotech firms such as Seattle Genetics choose to do business. Boeing also has offices in both locations.

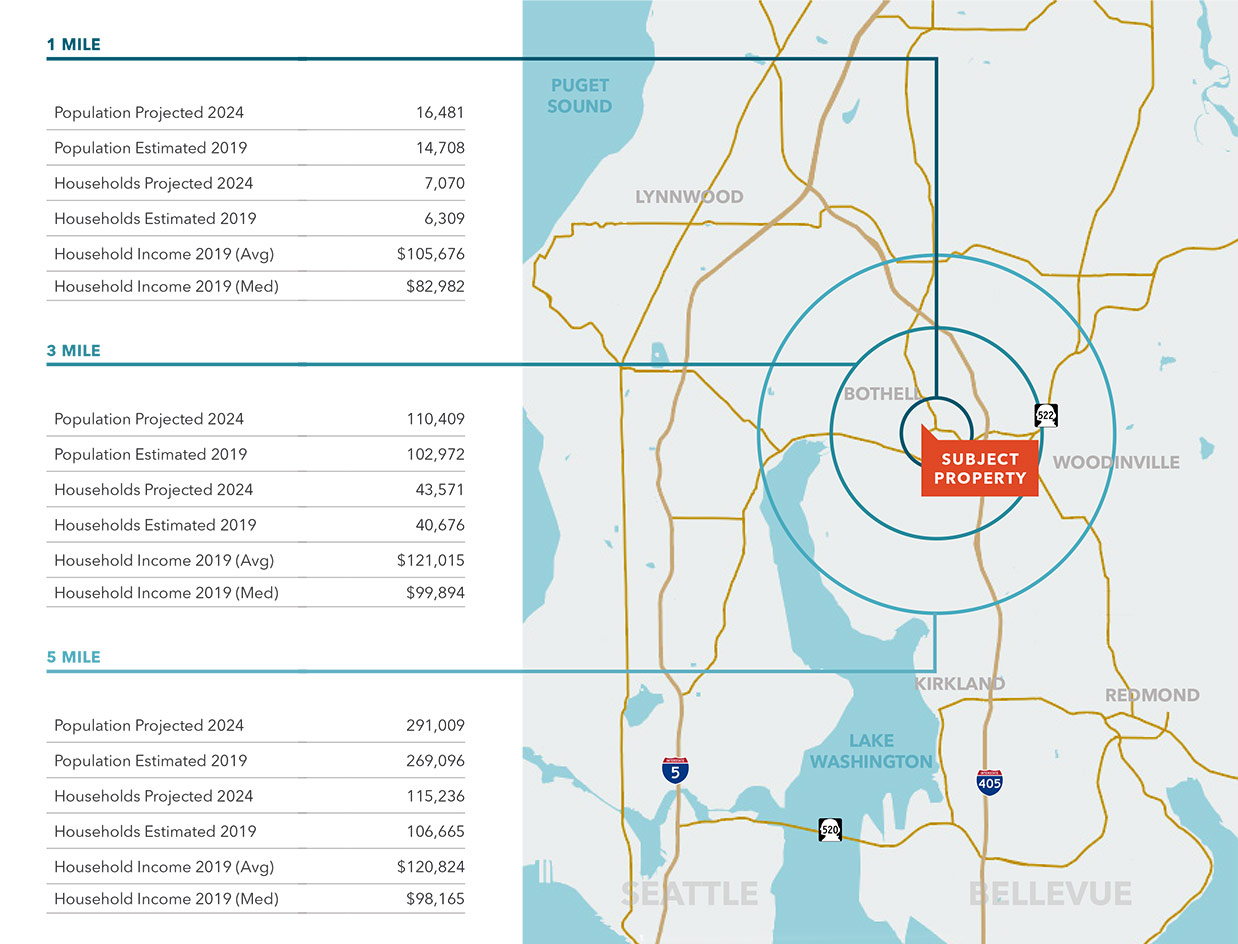

The inventory of apartments in the submarket has increased substantially over the last five years. At the same, time vacancy in newer units has remained consistent with the five-year average due to strong lease-up activity.

Rents in Bothell/Kenmore have traditionally been slightly higher than the Metro average, but the gap has widened since the beginning of the recovery. New units have contributed to the solid increase in rents, with asking rents reaching levels comparable to some of the region’s urban core submarkets. One-bedroom units in buildings built since 2000 average $1,700 per month.

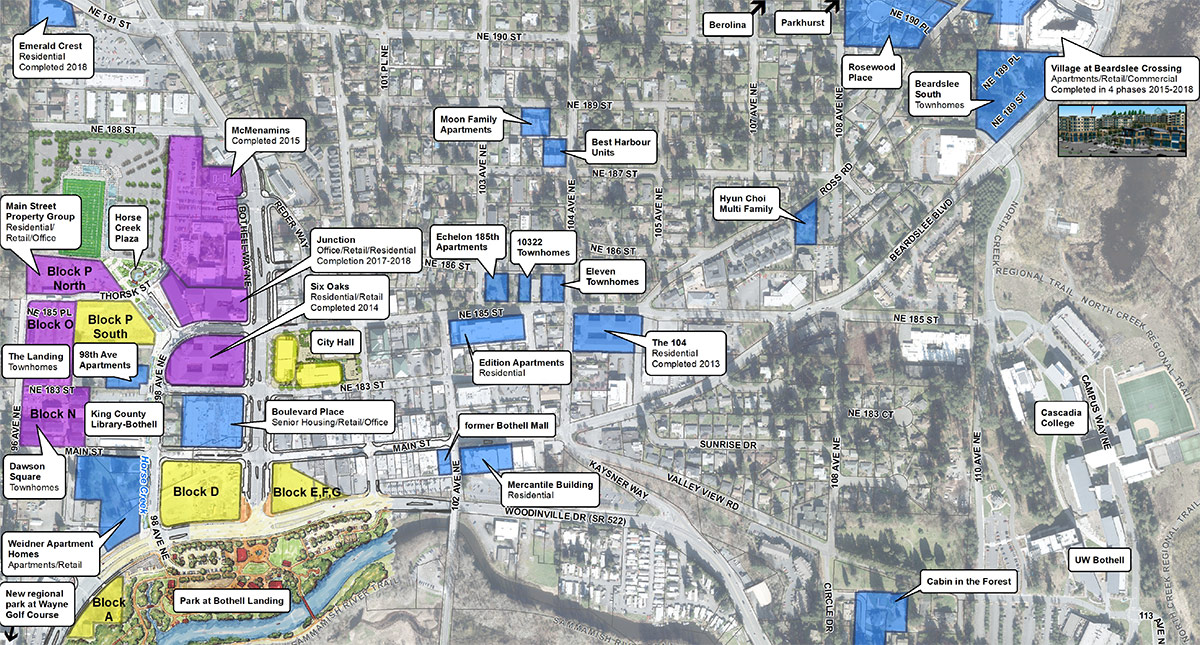

Construction activity in Bothell/Kenmore remains dynamic. Nearly 1,400 units were delivered from 2013 to 2017, and more than 1,100 units are slated to deliver between 2018 and 2019. Once these properties deliver, the submarket will have expanded its inventory by 45% since the end of 2012. This trend could become even more pronounced if proposed projects materialize. Downtown Bothell has become a popular spot for development and is transforming rapidly.

More than 900,000 SF of retail, office, hotel, and residential development is in planning, and the expansion of Bothell Way illustrates the impact high-paying tech and life sciences jobs can have on a previously sleepy submarket. Examples of new apartment projects include Main Street Property Group's 130-unit Junction which opened in January 2018 and was able to reach 67% occupancy by early August, a leasing rate of approximately 13 units per month. The community was offering up to one month of free rent during the first several months of lease-up. A few blocks away, Goodman Real Estate's 122-unit Merc Bothell opened in September 2018 and it was reportedly 40% occupied by mid-November, a leasing rate of roughly 16 units per month. Management was offering up to six weeks of free rent on select units at the project.